Investmentmarket

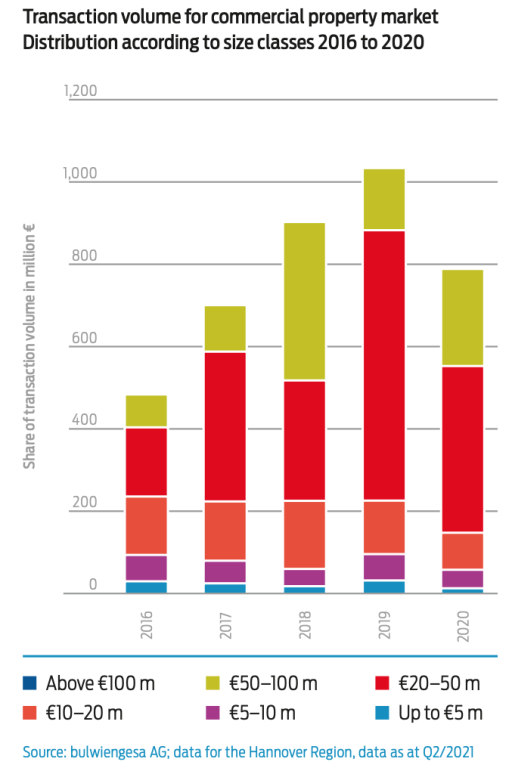

TO €785 MILLION, EVENTUALLY ACHIEVING AN AVERAGE LEVEL.

Investmentmarket

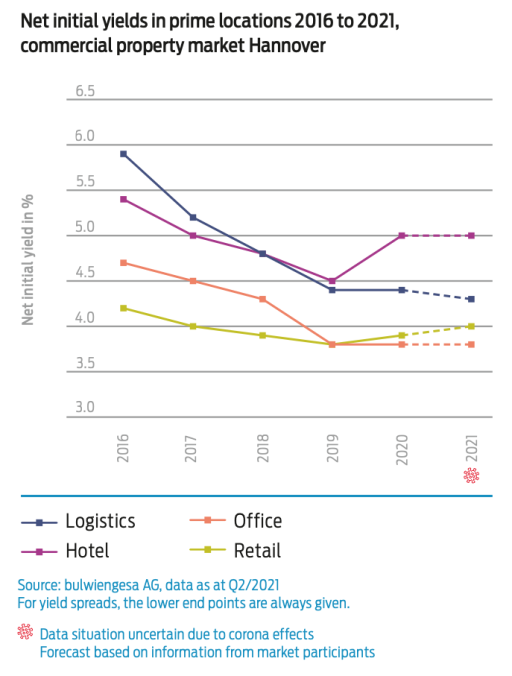

The Hannover Region is an innovative industrial location, a service metropolis and a logistics hub for national and international markets. The regional economy had developed positively in recent years leading to a sustained demand for property in all submarkets. This consolidated and expanded Hannover's position as the most important location in Germany behind the country's seven A-locations. At the same time, Hannover has been offering ever more appealing investment opportunities and attracting investors wanting to invest in locations that retain value

MARKET MOOD AND TRENDS

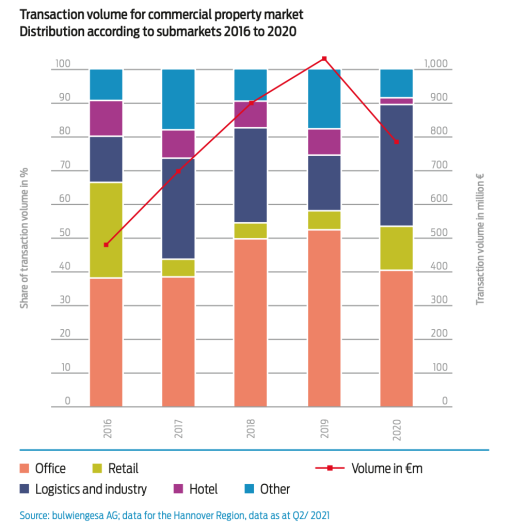

After a record year in 2019, the first quarter of 2020 initially looked promising. In the second and third quarters, however, market activity and thus also the property investment market in the Hannover Region slumped significantly. However, at around €785 million, investment volume in 2020 was in the end even slightly above the long-term average of around €780 million/year, although this latter figure was largely shaped by the very strong years of 2018 and 2019.

The crisis has had a particularly strong impact on three of the four main commercial asset classes: retail, hotels and, more recently, offices. The results can therefore be regarded as relatively high, underlining the overall stability of the property market in Hannover. The strong fourth quarter was the main contributor to the overall satisfactory result.

The first half of 2021 in the Hannover Region got off to a relatively subdued start. Investments of around €250 million have so far been recorded, but the actual figure is likely to be somewhat higher with other transactions made during the first half of the year usually becoming apparent during the course of the year.

The largest known single transaction of the year to date has been a developer purchase of a logistics project in the south-east of the Hannover Region at a transaction volume of well over €50 million.

DESPITE THE CORONA CRISIS, THE PROPERTY MARKET IN HANNOVER CONTINUES TO PROVIDE NEW, CORE QUALITY PROPERTIES.

New future developments are likely to focus much more on sustainable usage and sectors than on high short-term returns. Flexibility, digitalisation and the ability to deal with crisis situations (e.g. from pandemics and climate change) will also be future key issues for the property market. Locations such as Hannover will only be able to compete nationally if they are able to build on such strengths, expand them and meet the demand for core properties with the characteristics described above.

Hannover has the right conditions in place. Confidence is there, pre-leasing rates on new projects are falling, and new ventures are in the pipeline. Market players in Hannover are optimistically preparing for the post-pandemic era.

Data in detail

Transaction volume for commercial property market Distribution according to size classes 2016 to 2020

Transaction volume for commercial property market Distribution according to submarkets 2016 to 2020

Contact

Hilmar Engel

Region Hannover

Wirtschaftsförderung

Fachbereich Wirtschafts- und Beschäftigungsförderung