Logistics Property Market

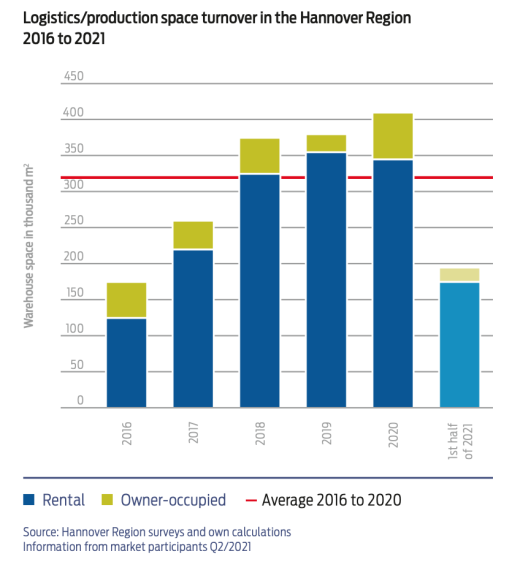

The Hannover Region is a European logistics hub and important hinterland port location for seaports in northern Germany. Commercial and industrial companies are the main drivers of demand in the regional logistics industry. In recent years, many contract logistics companies have established themselves at the location, carrying out logistics tasks for other companies and thus creating a high level of added value for themselves. Warehouse space turnover at the end of 2020 was at a high of 410,000 m2.

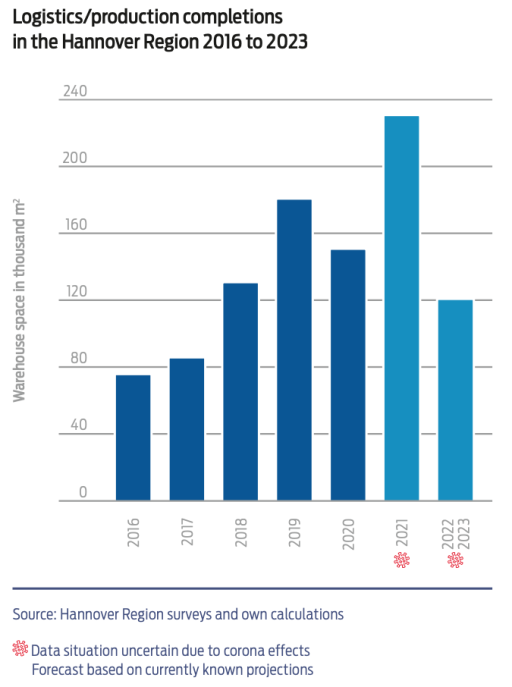

In the past five years (2016 to 2020), around 620,000 m2 of warehouse space for logistics and production has been built in the Hannover Region. Projects planned or already known for the years 2021 to 2023 add up to approx. 350,000 m2 of warehouse space.

|

Logistics space available in 2021 in m2 |

3,71 m |

|

of which constructed after 2010 |

1,45 m |

|

Logistics space turnover in 2020 in m2 |

410.000 |

|

of which rentals of which owner-occupied |

345.000 65.000 |

|

Logistics space turnover 1st half of 2021 in m2 |

195.000 |

|

of which rentals of which owner-occupied |

175.000 20.000 |

|

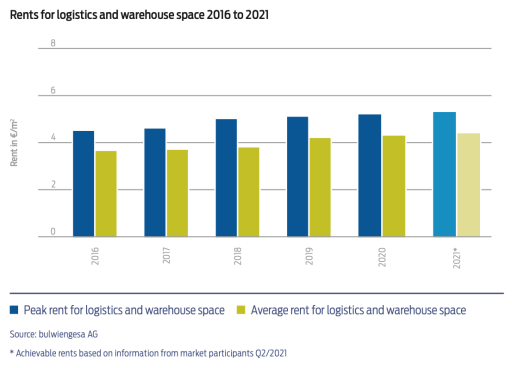

Rents in prime locations 2021 |

|

|

Peak rent in €/m2 Average rent in €/m2 |

5,30 4,40 |

|

Net initial yield of logistics centres in prime locations 2021 |

4,3 % |

A record turnover of around 410,000 m2 of warehouse space (plus 30,000 m2 or 8%) was again registered for logistics and industrial properties in 2020. Rents have remained largely stable, with the peak rent in 2020 at 5.20 €/m2. 2021 already got off to a dynamic start with around 200,000 m2 of warehouse space turnover recorded at mid-year, and both peak and average rents rising in the first half of the year (up 10 cents in each case). The corona pandemic seems to have had hardly any effect on activities in the logistics and production property sector. The persistent high rate of space turnover is placing constraints on supply.

Online retailing, which has grown as a result of the crisis, has strengthened upstream and downstream logistics. For property and logistics infrastructures designed primarily for industrial logistics, the situation is tense nationwide with the automotive sector being particularly hard hit. Despite this, project developers and companies in the Hannover Region continue to be very active in this area, in contrast to the national trend.

Regional market players can foresee that in the medium to long term an increased demand for logistics and production space (for light industries) will arise by production being brought back to Europe. To improve supply chain security in retail and industry as a whole and make them more crisis-proof, increased logistical space requirements are also likely to arise in the Hannover Region. The huge increase in the importance of e-commerce during the corona crisis and the related impact on "the last mile" in the courier, express and parcel services sector are currently also clearly reflected in the demand for space.

A look at the investment market clearly shows that the importance of logistics and industrial property as an asset class is increasing. Investments in this area in the Hannover Region in 2020 were second highest directly behind office properties, and increased significantly (to around €285 million, plus 68%).

LOGISTICS AND INDUSTRY CONTINUE TO SIGNIFICANTLY INCREASE THEIR IMPORTANCE ON THE REGIONAL PROPERTY MARKET.

Market participants are optimistic about the rest of 2021. Vacancies are at their lowest for years and rental prospects are without exception rated as good to very good. In the corona crisis, the logistics industry has not only proven itself to be strong and stable in the property market, but has also demonstrated its cross-sectoral importance for the regional economy. The continued increasing demand will soon become a challenge, as it is only possible to designate a limited amount of new commercial space. Reactivating brownfield sites is therefore likely to gain momentum in the coming years, and not just in the context of sustainability issues.

Data in detail

Logistics/production space turnover in the Hannover Region 2016 to 2021

Logistics/production completions in the Hannover Region 2016 to 2023

contact

Hilmar Engel

Region Hannover

Wirtschaftsförderung

Fachbereich Wirtschafts- und Beschäftigungsförderung