RESIDENTIAL PROPERTY MARKET

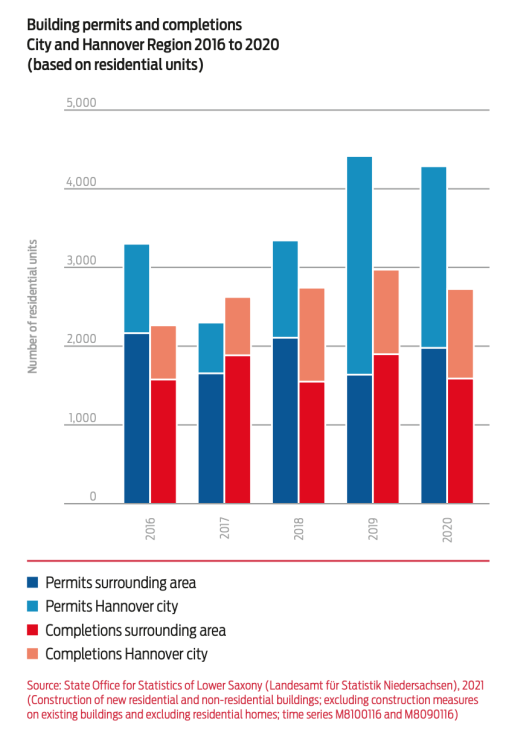

The residential property market in the Hannover Region is characterised by regional providers and demand from private households. Population growth in the state capital and neighbouring municipalities has led to rising demand in the residential property market in recent years. At the same time, housing completions in the city and surrounding area have been insufficient, so a considerable need for new housing exists at present and will continue in the future.

The corona crisis is not currently leading to a slowdown in demand or a decline in prices on the residential property market. On the contrary, an increased interest in housing can be observed.

|

Rents 2021 |

|

|

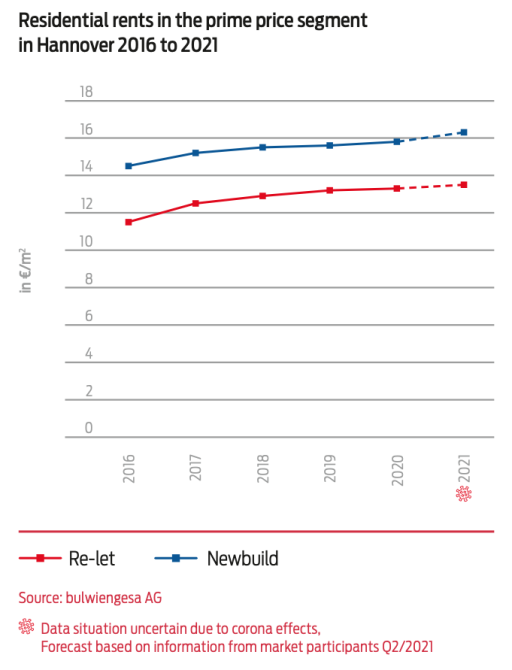

Newbuild, peak rent in €/m2 Newbuild, average rent in €/m2 Re-let, peak rent in €/m2 Re-let, average rent in €/m2 |

16,30 12,90 13,50 9,50 |

|

Home buying 2021 |

|

|

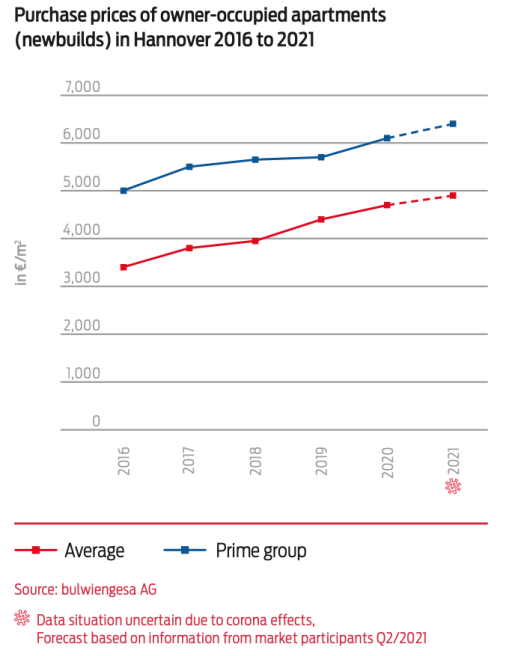

Owner-occupied apartment, newbuild, prime group in €/m2 Owner-occupied apartment, newbuild, average in €/m2 |

6.400 4.900 |

|

Multipliers 2021 |

|

|

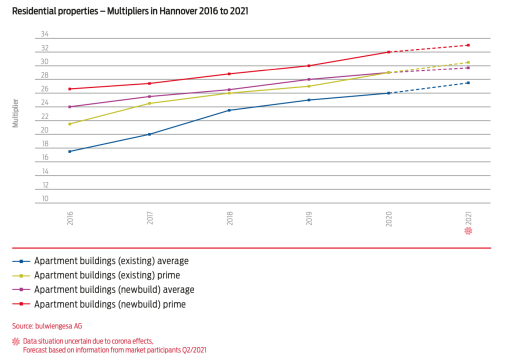

Apartment blocks / investment properties, newbuild, prime group Apartment blocks / investment properties, newbuild, average Apartment blocks / investment properties, stock, prime group Apartment blocks / investment properties, stock, average |

33,0 29,7 30,5 27,5 |

The residential property market is showing itself to be crisis-proof and undaunted by the effects of the corona pandemic. A brief corona slump at the beginning of the first lockdown was probably more due to a general wait-and-see attitude and initial uncertainty.

Supply and demand for residential real estate are currently strong. Purchase prices, rents and yield multipliers are stable to rising. In the coming years, the greatest challenge will still be meeting the demand for housing across all segments and price classes. No negative impact from the pandemic on ongoing and planned projects is currently discernible.

DIGITAL INFRASTRUCTURES AND EXTRA SPACE FOR WORKING FROM HOME ARE BECOMING PRIORITIES IN CHOOSING WHERE TO LIVE.

Regarding the quality of supply, residential building developers note above all an increased priority for optimal digital infrastructures and good accessibility of the residential area, also by foot and bicycle. Similarly, the increased space required for working from home is playing a stronger role in choosing a place to live. Living close to the workplace, on the other hand, is becoming less important from the point of view of market actors.

To meet the undiminished demand for affordable or subsidised housing, regional actors see a need for future action. From

the perspectives of project developers and housing construction companies, any scope for increasing prices for privately financed apartments is almost exhausted. This is posing increasing problems for companies due to residential construction developments in the past having usually been possible through publicly and privately cross-financed projects.

Data in detail

Purchase prices of owner-occupied apartments (newbuilds) in Hannover 2016 to 2021

Building permits and completions City and Hannover Region 2016 to 2020 (based on residential units)

Residential rents in the prime price segment in Hannover 2016 to 2021

contact

Hilmar Engel

Region Hannover

Wirtschaftsförderung

Fachbereich Wirtschafts- und Beschäftigungsförderung