Office Property Market

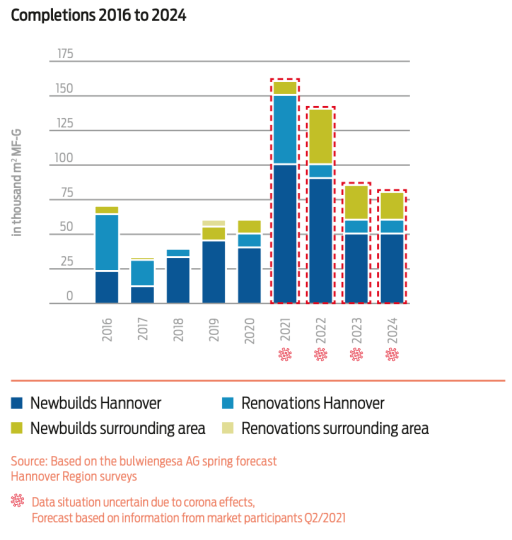

In 2020, office space turnover amounted to around 145,000 m2, which represents a good year for the Hannover office market, despite the corona pandemic. The first half of 2021 got off to a somewhat subdued start with office space turnover of around 55,000 m2. There continues to be no shortage of attractive projects. In the past five years (2016 to 2020), around 180,000 m2 of new office space has been built and a further 80,000 m2 has undergone complete renovation. The list of project developments is long. By 2023, a further 385,000 m2 is to be added (of which 70,000 m2 will be redevelopment).

|

Office rental space 2021 in m2 MF-G* |

5,2 m |

|

Hannover City Surrounding towns of Garbsen, Laatzen and Langenhagen |

4,7 m 0,5 m |

|

Office space turnover 2020 in m2 MF-G* |

145.000 |

|

Hannover city Surrounding towns of Garbsen, Laatzen and Langenhagen |

139.000 6.000 |

|

Office space turnover 1st half of 2021 in m2 MF-G* |

55.000 |

|

Hannover City Surrounding towns of Garbsen, Laatzen and Langenhagen |

54.000 1.000 |

|

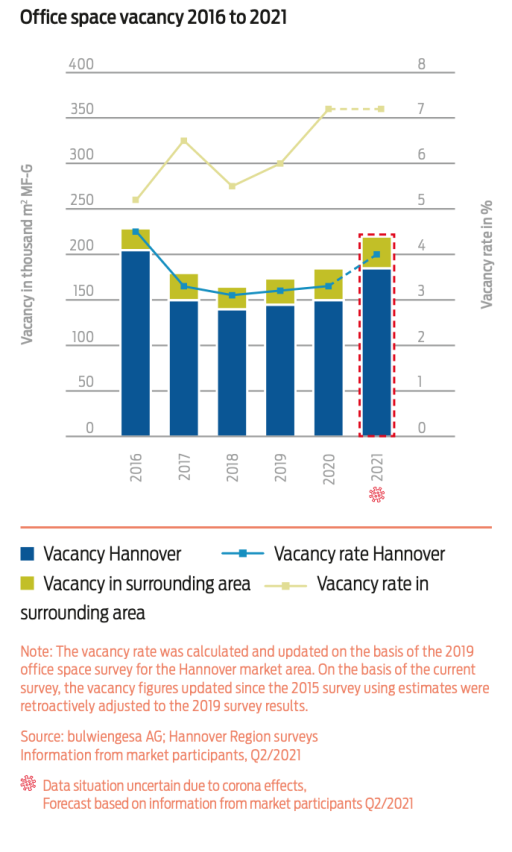

Vacancy rate 2021 in m2 MF-G* |

220.000 |

|

Hannover City Surrounding towns of Garbsen, Laatzen and Langenhagen |

185.000 35.000 |

|

Vacancy rate 2021 |

4,1 % |

|

Hannover City Surrounding towns of Garbsen, Laatzen and Langenhagen |

4,0 % 7,2 % |

|

Peak rent 2021 in m2 MF-G* |

|

|

City City periphery |

17,00 15,30 |

|

Average rent 2021 in m2 MF-G* |

|

|

City City periphery |

12,90 11,60 |

|

Net initial yield in prime city locations 2021 |

3,8% |

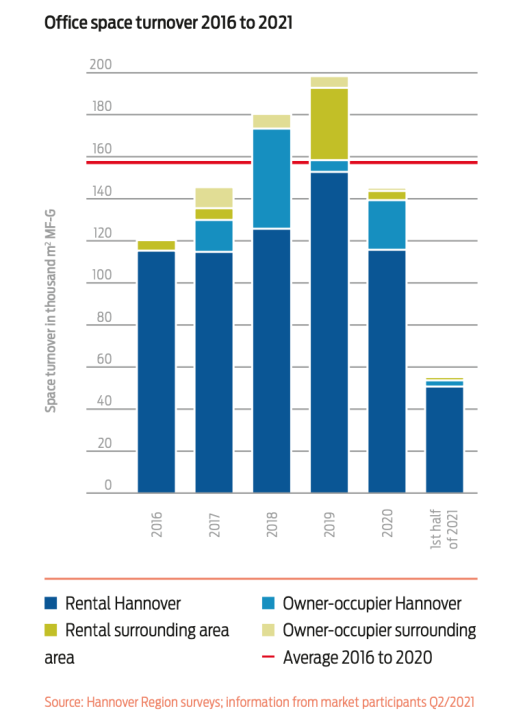

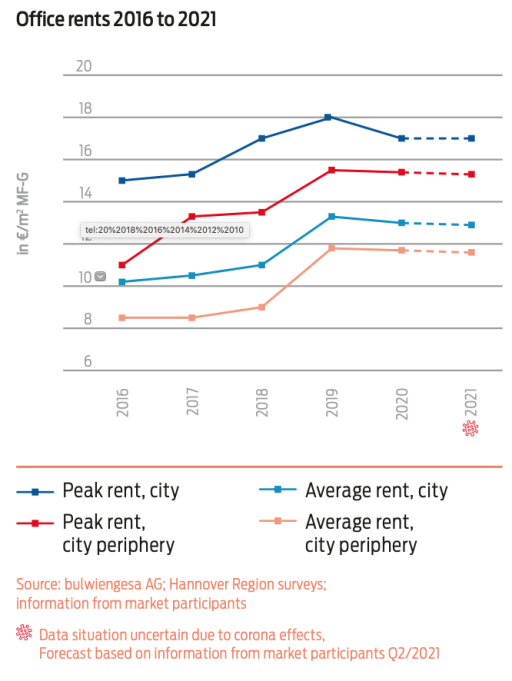

Annual figures for the office property market show a significant decline. Office space turnover at the end of 2020 was around 145,000 m2 (down 53,000 m2 or 27%), with peak rents falling (down €1 to €17 per m2 or 5.5%).

However, in 2020, the decline in the office property market was particularly high because it followed the record years of 2018 and 2019. Economic slowdown before corona meant there were already initial signs of a cooling down at the end of 2019 / beginning of 2020. The rise seen in inner city rents over recent years would probably have levelled off in 2020 even without the impact of the corona crisis. On a five-year average, space turnover is slightly below 160,000 m2. The current situation is confirming these trends, with space turnover and rents stabilising at a still high, but now slightly adjusted level.

The positive picture of 2020, compared to the overall situation, has been sustained by an exceptionally strong first quarter. With the onset of corona restrictions, market activity on the local office property market did come to a standstill. However, by mid-year, the initial phase of uncertainty seemed to have been overcome. In general, strategic projects did not come to a halt and negotiations that had already begun were concluded unchanged.

In the investment sector, despite a decline of a good 40%, attractive deals were also concluded with a volume totalling around €320 million. This still puts the market well above the levels seen before the record years of 2018/2019.

HANNOVER REMAINS A SOUGHT AFTER AND BOUYANT OFFICE LOCATION DESPITE THE CORONA SLUMP.

The first half of 2021 got off to a subdued start, with turnover at around 55,000 m2 and peak rents remaining stable. It remains to be seen how office space turnover and rents will actually develop by the end of 2021. It is still unclear what effect the crisis-induced intensification of digital work practices and increased working from home (remote working) will have in the long term and whether the trend towards flexible office space rentals and co-working, which has also recently been observed in Hannover, will strengthen again after the crisis.

The fact that there are many development projects in the pipeline is cause for optimism. Office space totalling around 385,000 m2 is expected to be completed by the end of 2023. The number of office employees in Hannover is expected to continue to rise in the coming years, so working from home and digitalisation are likely to only have a short-term and slight dampening effect on office rentals and project development volumes. Developments in the office property market are closely linked to overall economic development in the Hannover Region and in Germany. Market participants are currently generally optimistic about the future of the office property market.

data in detail

office space turnover 2016 to 2021

office space vacancy 2016 to 2021

Note: The vacancy rate was calculated and updated on the basis of the 2019 office space survey for the Hannover market area. On the basis of the current survey, the vacancy figures updated since the 2015 survey using estimates were retroactively adjusted to the 2019 survey results.

Source: bulwiengesa AG; Hannover Region surveys Information from market participants, Q2/2021

*Data situation uncertain due to corona effects,

Forecast based on information from market participants Q2/2021

office rents 2016 to 2021

contact

Hilmar Engel

Region Hannover

Wirtschaftsförderung

Fachbereich Wirtschafts- und Beschäftigungsförderung