Retail Property Market

In terms of turnover, the Hannover Region is one of the strongest retail locations in Germany. Forecasts for 2021 put retail turnover in the Hannover region at around €7.2 billion. In addition to the Hannover city centre with its prime locations in Georgstraße, Große Packhofstraße, Karmarschstraße and Bahnhofstraße, Hannover's retail location is characterised throughout the region by specialist retail centres, shopping centres, city district locations and attractive town centres in the surrounding areas.

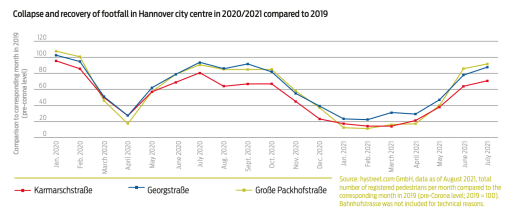

During the corona crisis, those locations with local shops supplying essentials particularly gained in customer popularity. Visitor numbers in the city of Hannover have recently returned to pre-corona levels. However, drastic structural and strategic changes are imminent in the city centre, not least due to the vacancy of the former Karstadt store in Georgstraße.

|

Sales area Hannover Region in m2 |

2,1 m |

|

Surrounding area Hannover City of which inner city Hannover (Mitte district) |

1,15 m 0,84 m 285.000 |

|

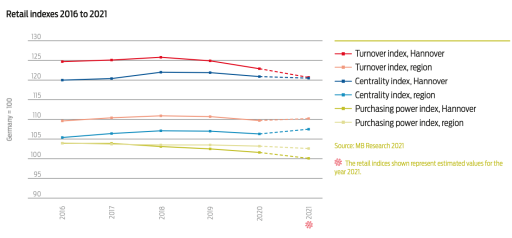

Retail centrality 2021* (Germany = 100) |

|

|

Hannover City Surrounding area |

120,5 107,5 |

|

Purchasing power 2021 in €* |

8,07 b |

|

Hannover City Surrounding area |

3,67 b 4,40 b |

|

Retail sales 2021 in €* |

7,18 b |

|

Hannover City Region (incl. Hannover city) |

3,67 b 3,51 b |

|

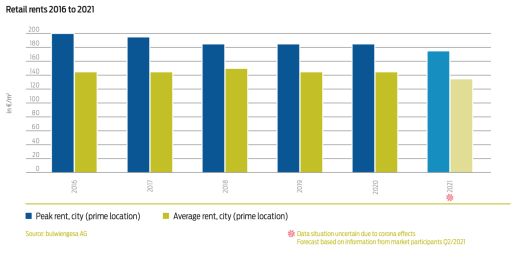

Rents 2021* |

|

|

Peak rent, prime city location in €/m2* Average rent, prime city location in €/m2* |

175 135 |

|

Yields 2021* |

|

|

Net initial yield in prime locations* Net initial yield in specialist retail centres |

4,0 % 4,5 % |

Since March 2020, combating the COVID 19 pandemic with several lockdowns between spring 2020 and early summer 2021 has led to an unprecedented deterioration in the economic situation of businesses, especially in traditional retail locations in the city centres of Hannover and the surrounding area. This has also impacted on new business with space turnover in the city centre falling by around 75% in 2020 compared to the previous year, to just over 2,000 m2.

Food retailers and local shops, by supplying essentials, were able to escape the corona downward trend in the rest of the retail sector and, in some cases, substantially increased their sales. Such crisis-driven spikes in demand normalised comparatively quickly. In Hannover's city centre, trends were characterised by strong fluctuations. During the hard lockdowns in April 2020 and from December 2020 to April 2021, visitor numbers in the city centre declined by up to 90%. Overall, footfall in Hannover's city centre fell by around a third in 2020 compared to 2019, and by as much as two thirds in the first half of 2021 compared to the 2019 pre-corona levels. According to retailers, some of the sales losses are likely to be much greater.

Visitor numbers in the city centre are currently rising again towards pre-corona levels, and the consumer mood outside online retail seems also to be on the rise again. On the whole, signs point to an initial easing of the situation in traditional city centre retailing. Nevertheless, it will probably take some time before things return to normal. Revenue losses for tenants in recent months have also affected retail property owners, resulting in rent losses or requests for rent reductions. By mid-2021, rents, which were recently still estimated to be stable, had already fallen by around €10 to a peak of now €175 per m2.

Many retail businesses are currently adopting a wait-and-see attitude. This should also have an impact on the demand for and positioning of retail properties on the investment market. How strong the impact will be and how long it will last is difficult to estimate at present. Sales of specialist retail centres and shops supplying essentials even resulted in an increased invest- ment volume of around €75 million (plus €20 million) last year. However, the properties being sold were mainly those with users relevant to the local supply of essential goods.

CORONA CRISIS ACCELERATING RETAIL TRANSFORMATION.

Corona should however not be seen as the trigger for an unprecedented crisis in traditional retailing, but rather as an accelerator of existing trends. In Hannover's prime locations, a decline in rents had already been observable over recent years. Online retail is the current growth driver in the retail sector and can consolidate its position and expand at the expense of brick- and-mortar retailing. Insolvencies, particularly in the case of large department stores, fashion retail and catering, could lead to many concepts (including chain stores) permanently leaving the location. Businesses in city district locations and in integrated retail locations in the surrounding areas currently seem to be benefiting from their proximity to customers and their function as local suppliers of essentials.

Daten im Detail

Retail indexes 2016 to 2021

Retail rents 2016 to 2021

Collapse and recovery of footwall in Hannover city centre in 2020/2021 compared to 2019

contact

Hilmar Engel

Region Hannover

Wirtschaftsförderung

Fachbereich Wirtschafts- und Beschäftigungsförderung